Evergrande Default China | China Tells Evergrande To Avoid Near Term Dollar Bond Defaults Debt News Al Jazeera

The ratings agency said that the Chinese developer is likely to default on its 246 million offshore dollar-denominated bond due Oct. Cash-strapped developer China Evergrande Group averted a destabilising default at the last minute for the third time in the past month with a source on Thursday saying several bondholders had.

China Evergrande Warns Of Default Risks H1 Profit More Than Doubles Asia Financial News

Chinas Evergrande repays bondholders.

Evergrande default china. Evergrande is Chinas most indebted developer with 300 billion worth of liabilities. Chinas embattled developer Evergrande is on the brink of default. Evergrande remitted 835 million to a trustee account at Citibank on Thursday to pay all bondholders before the payment grace period ends on Saturday as reported on Friday by state-backed Securities Times and confirmed.

CNN BusinessChinas real estate crisis isnt showing any sign of letting up. Once a darling of Chinas booming property sector Evergande is now at risk of the countrys largest-ever corporate default with more than 400 billion in debts triggering financial woes in the. Analysis Chinas public debt already stands at 270 percent of GDP and non-performing loans have hit 4669 billion.

Uncertainty continues to surround Chinas bleeding second-largest real estate developer the Evergrande Group which faces over 300 billion worth of debt and likely wont find a bailout in the form. Heres why it matters Published Thu Sep 16 2021 910 PM EDT Updated Mon Oct 11 2021 955 PM EDT. Property Developer Evergrande Avoids Default With a Last-Minute Payment According to Chinese Media.

The rescue of embattled Chinese property company Evergrande appears to have stalled leaving the developer on the brink of default and threatening to unleash contagion through the countrys. Evergrande China Federal Reserve Financial Stability Report Talking Points Evergrande makes overdue coupon payments for offshore bonds staves off default Fed highlights Evergrande. Chinas property sector stalked by Evergrande default fears as developer misses third deadline Posted Tue 12 Oct 2021 at 224pm Tuesday 12 Oct 2021 at 224pm Tue 12 Oct 2021 at 224pm.

Sinics local subsidiaries have already failed to make. Residential buildings under construction seen at Evergrande Cultural Tourism City a project developed by Evergrande Group in Suzhou Jiangsu province China on Sept. The company is part of the Global 500 meaning that its also one of the worlds biggest.

A failure to pay would have resulted in a formal default by the company and triggered cross-default provisions for other Evergrande dollar bonds. Over 50 of our rated portfolio of Chinese developers falls into this ratings category The SP analysts believe Evergrande is likely to default on its debt eventually. An idle Evergrande residential project construction site next to completed but unoccupied buildings in Taiyuan China.

China Evergrande makes a payment before a default deadline state media says. It has already likely missed payments on two other US dollar-denominated bonds fueling speculation over. Evergrande Default Could Rock Chinas Entire Economy.

Chinas Evergrande default concerns loom large on nervous market With Beijing not showing any signs of stepping in to help the developer concerns over spillover risks remain high. Today markets are fretting over a potential default by Evergrande a highly indebted Chinese real estate behemoth an event that some believe could set off a global financial panic. Police buses parked in front of the China Evergrande Group headquarters in Shenzhen China.

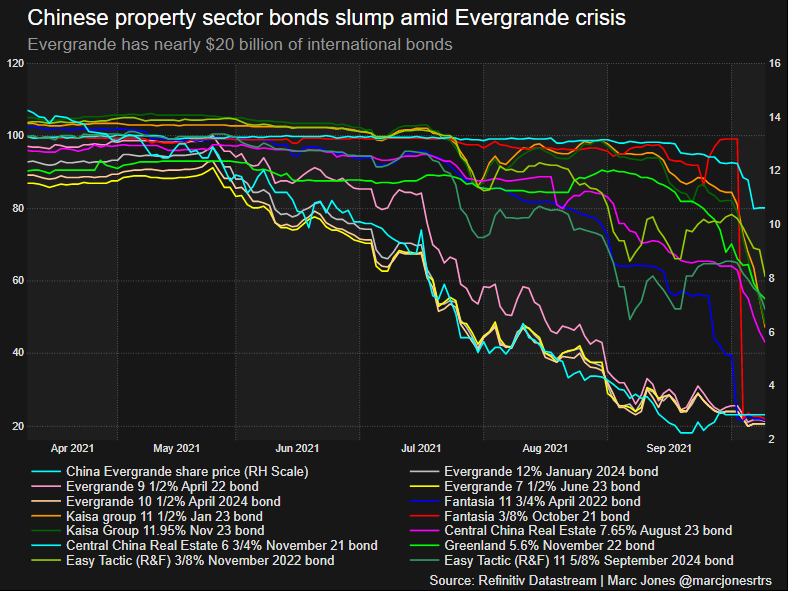

Embattled conglomerate Evergrande rattled global markets in September by warning it could default. As concerns about Chinese property giant Evergrande defaulting on its debt continue one expert says that Chinese. Evergrande Asias biggest junk-bond issuer is so entangled with Chinas broader economy that its fate has kept global stock and bond markets on tenterhooks as late debt payments could trigger.

In addition to existing economic challenges real estate giant Evergrande Group has signaled that it may default on payments owed to creditors. Evergrande is one of Chinas largest real estate developers. Chinese developer Evergrande meets interest payment deadline avoids default 02112021 Yahoo turns latest tech firm to quit China due to challenging environment.

China Evergrande Group has supplied funds to pay interest on a US dollar bond two days before a deadline that would have seen the developer plunge into formal default. China letting Evergrande default would be a no-go expert explains.

Evergrande Chinese Property Giant Warns Again That It Could Default On Its Enormous Debts Cnn

Evergrande Fall Risk Only A Short Term Inconvenience For China Trivium Asia Financial News

China Evergrande Investors Assess Risks Of Likely Default Nikkei Asia

China Evergrande Makes Payment To Dodge Default Media Says Nationalgridmedia

Fitch Downgrades China Evergrande Flags Probable Default Reuters

China Evergrande Says Property Sales Drop Warns It Could Default

As Evergrande Default Looms What Legal Options Do Offshore Creditors Have Reuters

China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021

Timeline Of A Crisis The Worsening Finances Of China Evergrande Asia Financial News

Why Evergrande S Debt Problems Threaten China The New York Times

China S Evergrande Default Concerns Loom Large On Nervous Market Business And Economy News Al Jazeera

China Tells Evergrande To Avoid Near Term Dollar Bond Defaults Debt News Al Jazeera

China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021

China Has Means To Address Evergrande Default Imf Official Nikkei Asia

China Evergrande S Troubles Are Wrecking Xi S Economic Story Nikkei Asia

Evergrande Liquidity Crisis Why The Property Developer Faces Risk Of Default Financial Times

China S Property Sector Stalked By Evergrande Default Fears Reuters

Evergrande Default Could The Property Giant S 250 Billion Debt Spark A Global Financial Crisis Euronews